How’s the market? It’s the most common question I get, and for about four months now the answer has been foggy. On one hand, homes are selling. On the other hand, the market has felt sluggish. Showing activity has been down and days on market have been longer. Still, homes are selling, and prices have been holding steady compared to a year ago.

Let’s look at some charts and see what the data is telling us. These charts are for BOISE RESALE. There’s plenty of reporting out there for Ada County, but that lumps together new construction and existing homes. We like to do our own analysis of the Boise resale market—regular homeowners selling existing homes. If you want a resale analysis for Meridian, Eagle, Kuna, Star, or beyond, hit us up—we’re happy to dig into the numbers for any area of the Treasure Valley.

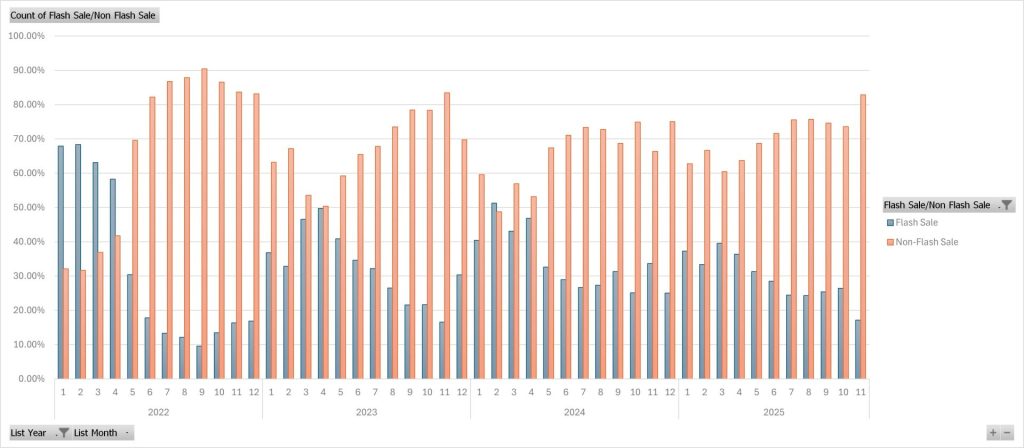

Flash Sales

A Flash Sale is a sale that goes from new to pending within 7 days on market. When new listings are selling quickly, prices tend to go up. When new listings sit without much showing activity, sellers feel discouraged and buyers feel emboldened when that home they like on Zillow has twenty saves but no offers.

There’s definitely a seasonal pattern to flash sales—spring tends to be the peak, though in many years January and February can be relatively hot. This chart is interesting because it shows the dramatic start to 2022 before interest rates rose, followed by the equally dramatic pullback in June when the Fed announced their first major rate increase. That had a chilling effect on the market until things normalized in the spring of 2023, then slowed significantly in the 4th quarter, before settling into a more normal pattern in 2024 and 2025.

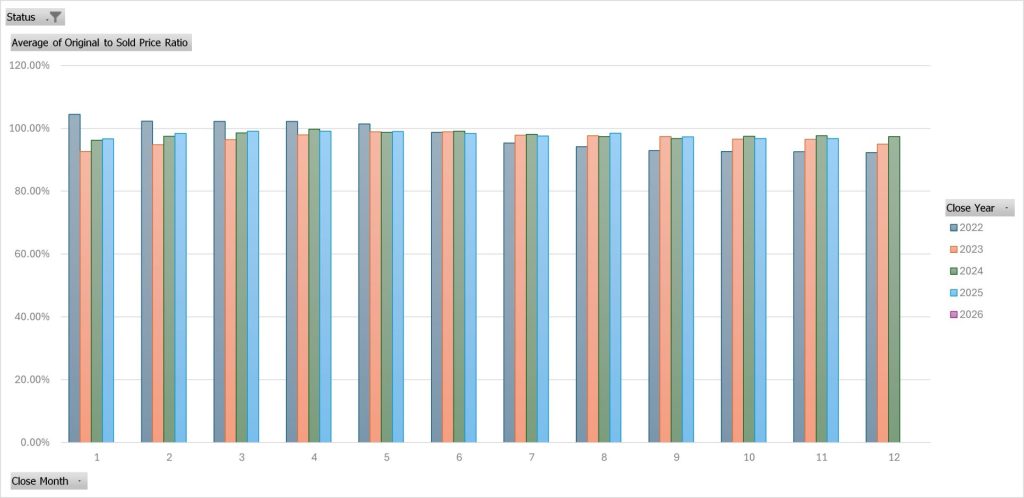

Original Price to Sold Price Ratios

Most reporting for list-to-sold price ratios uses the asking price at the time of pending. This chart shows the original price to sold price ratio. We’ve had a lot of price reductions lately, and the sold-to-original ratio is a good one to track.

Note that the past few years have been relatively similar, but in the past couple of months homes have been negotiated down more than last year. This aligns with the July/August slowdown—homes negotiated during those months are now closing with more sizable price adjustments. Our current average original-to-sold price is just over 96%.

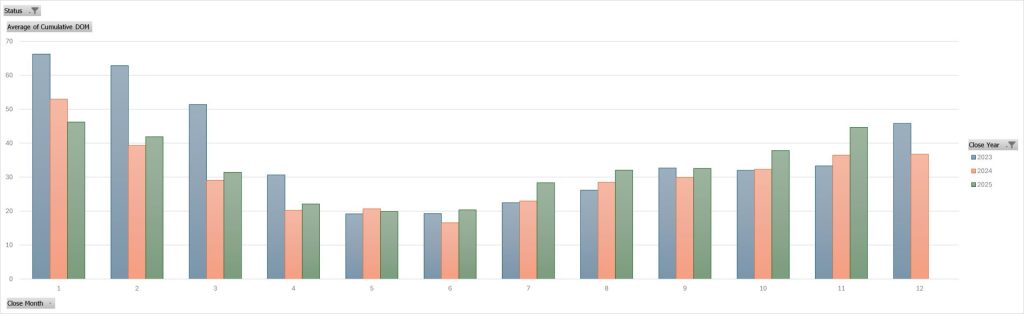

Average Continuous Days on Market

Continuous Days on Market (CDOM) reflects the total number of days a home has been on the market. If a house is listed, cancelled, and then re-listed, CDOM shows the total time it was marketed. Days on market have lengthened seasonally and are slightly above expectations, which lines up with the other shifts we’ve discussed.

Count of Pendings by Month

The bright spot is that pending sales over the past month have been pretty strong. While buyers are taking more time and negotiating more, they’ve still been active this fall.

While August and September look decent on this chart, it’s worth noting that when reviewed weekly:

- the first half of August was stronger than the second half, and

- the last part of September was stronger than the first.

This makes mid-August to mid-September our slowest stretch for pending sales, with a pick-up since then.

Looking Ahead

Overall, I wouldn’t be surprised to see a stronger-than-average remainder of November and a better-than-expected December, thanks to improving rates. I expect a stronger 2026, and while prices in 2025 are about the same as 2024, I’d expect that a year from now we’ll see pricing 2–5% higher in our local market. Buyers are sensing that we may be at a market bottom, price-wise, and they’re wisely entering the market now and negotiating.

The Boise economy remains strong. We have one of the strongest job markets in the country. I’m no economist, but I’ve seen firsthand how retirees flocked here from 2015–2022 (and still are). They bring disposable income and drive jobs in restaurant, retail, and healthcare—sectors that are fairly insulated from AI-related disruptions. And of course, retirees aren’t at risk of layoffs.

On top of that, we have massive job growth at Micron, plus growth at Meta and Amazon. I may have to eat my words later, but I suspect that job losses in other parts of the country may hurt real estate nationally while Boise holds stronger than most.

If rates drop meaningfully—which seems more likely than not—we could see a housing market that becomes more accessible to ordinary wage earners again.

Site by Ha Media

Site by Ha Media

Leave a Reply