March, 2025

Boise Resale Market Update: What’s Happening This Month?

The Boise real estate market is always evolving, and we know how important it is for homeowners and potential buyers to stay informed. Whether you’re thinking about selling, buying, or just keeping an eye on trends, understanding resale home data—separate from new construction—is key to making smart real estate decisions.

Unlike new construction, existing homes follow a different market cycle, yet most real estate reports lump them together. That’s why we take a closer look at the Boise resale market, providing data and insights specifically for the homes that people actually live in, love, and eventually sell. These homes require expert preparation and strategy to maximize value, and we’re here to break down what’s happening in the market right now.

This update focuses on Boise because it represents the largest and most consistent resale market in the area, but we’re always happy to run numbers for Meridian, Eagle, Kuna, Star, Middleton, Nampa, Caldwell, Emmett, Mountain Home—or beyond! If you’d like specific insights for your city, just reach out.

Now, let’s dive into this month’s Boise resale market trends.

Steady as She Goes

This month’s update continues the trend from last month—the market remains steady and fairly balanced. So far, it feels very similar to early 2024, though slightly weaker overall.

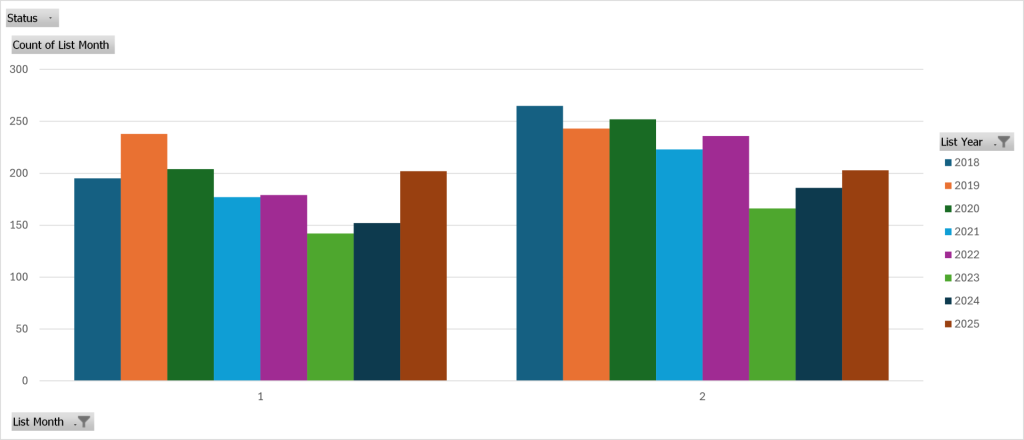

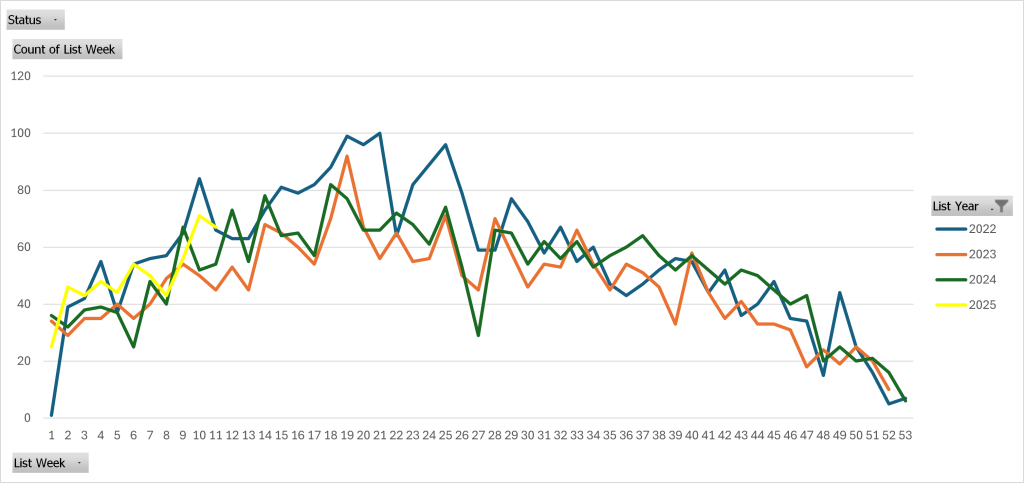

Last month, I reported that January saw a jump in new listings, but I speculated that the unseasonably warm weather may have played a role. February’s new listings did not maintain that same pace, and it does not appear we’re seeing a flood of new inventory—activity remains fairly normal. Typically, February brings slightly more new listings than January, but this year, February’s numbers are about the same as January’s.

Looking at listing activity going back to 2018, you can see that while new listings are up slightly year-to-date, we are still well below historical levels. This means we are not seeing an oversupply that would push prices down at this point.

What’s Holding Sellers Back?

Many sellers are also buyers, and while cash buyers are insulated from mortgage rate concerns, the rest of us are feeling stuck. Even with strong equity, homeowners hesitate to sell because current mortgage rates make moving cost-prohibitive. Many are waiting for rates to drop before leveraging their equity into a new purchase that won’t result in payment shock.

Pending Sales & Days on Market

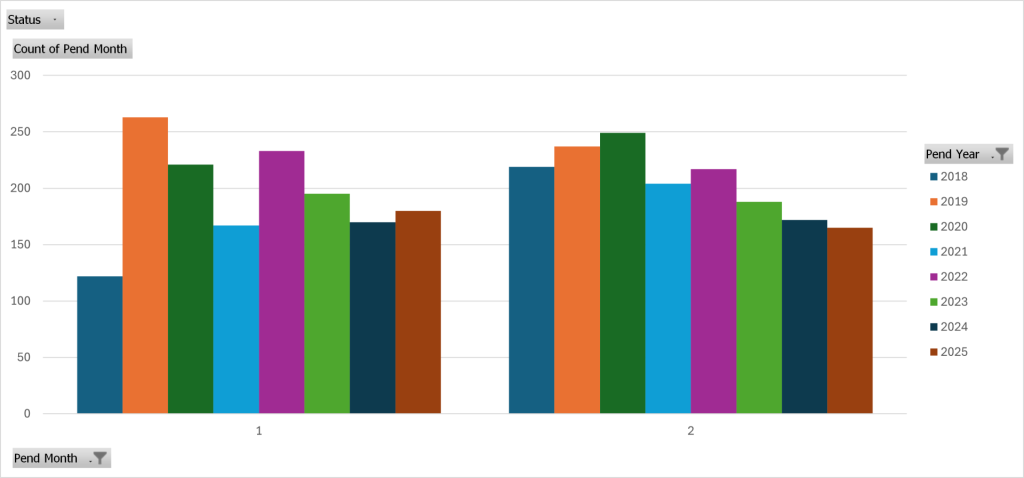

Pending sales for the first two months of the year show a similar pattern to new listings—steady but not surging.

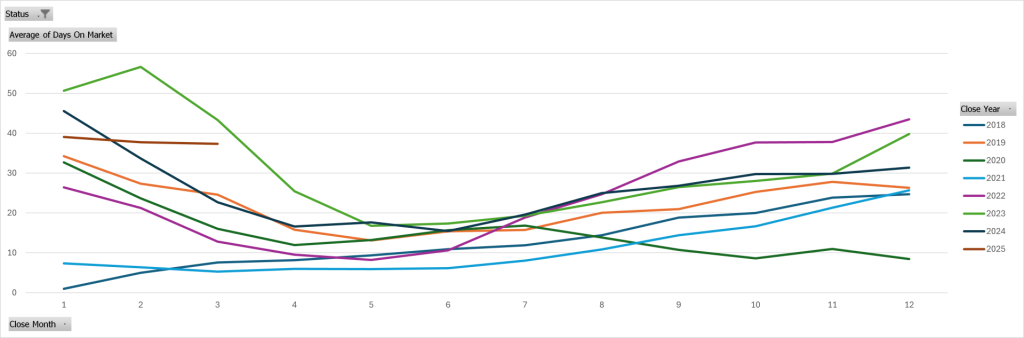

Average days on market for recent closings came in slightly higher than expected. Typically, we see days on market start to decline heading into spring, so we’ll revisit this next month to see if that trend holds. Last month’s closings had the highest days on market in recent years.

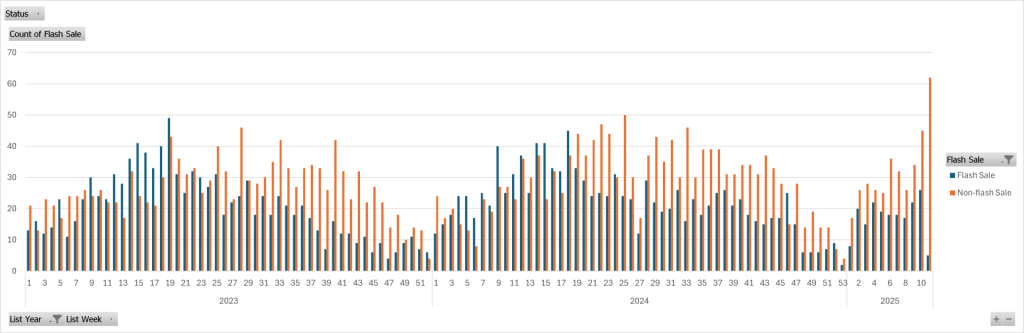

Flash Sales

Flash sales—homes that go pending within seven days of listing—are less common so far this year compared to past years. The most recent week’s data is skewed since those homes haven’t been on the market for a full week yet (this limitation fell outside my Excel skills—I’m open to coaching! 😉).

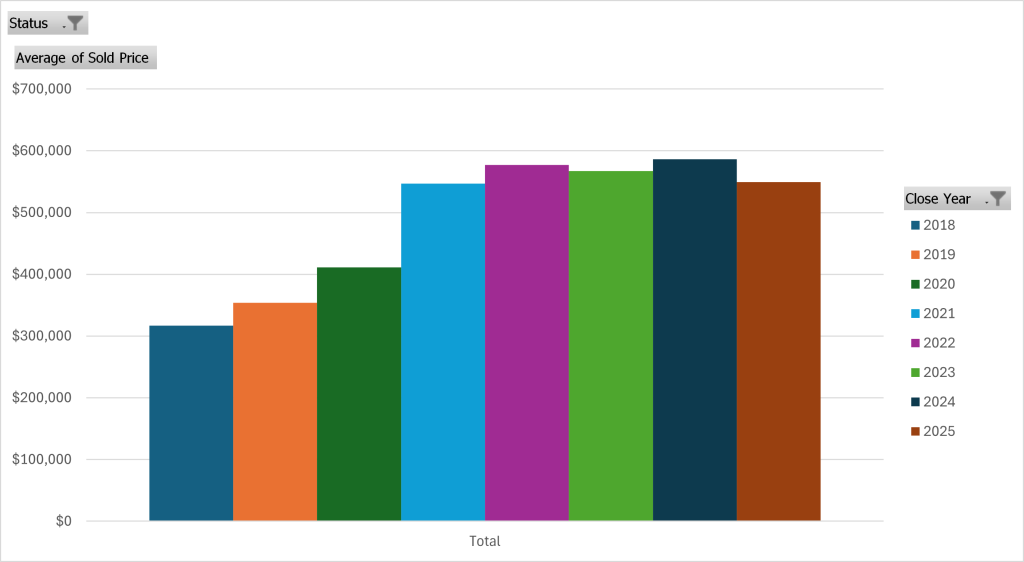

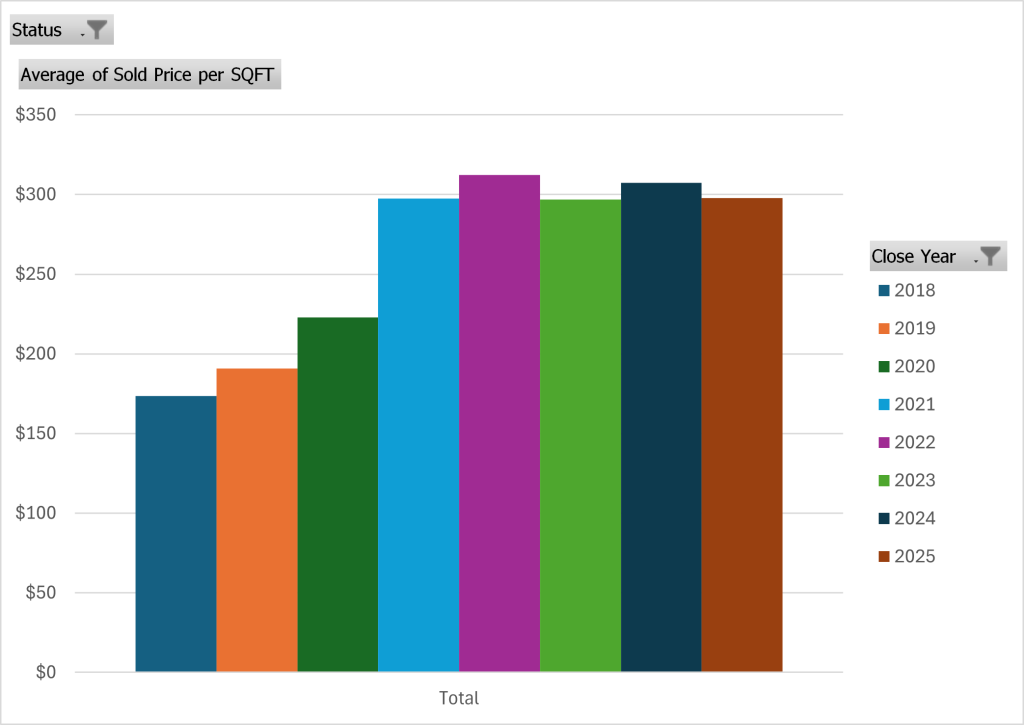

Pricing Trends

Both average sold price and average sold price per square foot are slightly lower year-to-date compared to past years. However, I’d like to see another month’s data before drawing conclusions—the differences aren’t huge.

That said, the bigger picture is clear: The past three years have been flat. Interest rates will be the biggest factor to change this, and when they do, the market will move quickly.

Despite the significant rise in interest rates, home values have held steady at the peak levels set during the post-COVID price surge. That’s pretty remarkable—we haven’t seen meaningful declines, even in this higher-rate environment.

What This Means for Buyers & Sellers

For sellers, this is a relatively balanced market, and strategic preparation is critical. We are putting immense effort into staging, marketing, and launch strategies to make sure our listings stand out and capture buyers’ hearts in a smaller buyer pool. Nothing is left to chance—every detail matters.

For buyers, now is a great time to buy—if the payment works for your budget. Prices have been flat for three years, and with wage growth, affordability has actually improved. While many buyers are waiting for rates to drop, that strategy comes with risks: when rates fall, competition will increase, and prices will likely rise. Right now is the least stressful market I’ve seen for buyers in the past seven years.

Final Thoughts

We’re here for any questions about your specific situation—we literally nerd out on real estate data every single day. And by “we,” I mean Andrea Pettitt, who has a deep and abiding love for market stats.

Happy spring, everyone! May your gardens start blooming and your time outdoors be joyful as the weather warms up. 🌸

Site by Ha Media

Site by Ha Media

Leave a Reply