It’s time for our monthly market update—and we’re officially in peak real estate season here at The Boise Group. We’ve had some fun new listings and pendings over the past few weeks, with even more on the way. Today alone, we’re working on five listings set to hit the market in the first week of May. It feels like the stars are aligning—sellers are ready, and buyers are showing up.

If you’re not already following us on Instagram, come join us @BoiseGroup! We’ve had some fun (and even a little viral) Boise content lately—thanks to our amazing social media manager, Grace. If you have ideas for posts, send them our way. We love sharing local stories.

So what’s happening in the Boise market this spring?

A colleague recently described it as “squishy,” and that word feels about right. Statistically, 2025 is shaping up a lot like 2024, though slightly weaker. The conversations we’re having with clients reflect more concern and uncertainty than we saw last year. Overall, showing activity is down. We’re still seeing offers, but buyers are expecting to negotiate more and we’re seeing more homes coming back on market during escrow. Overall it’s a reasonable market–even a good market–and it is also a little trickier to read. Homes we thought would fly off the market have taken longer to sell, yet some other surprised us with short market times.

Let’s take a look at a few charts we created from the most recent MLS data. These are specific to Boise’s single family (not condos or townhomes) residential resale market (excluding new construction). I (Andrea Pettitt) exported nearly 25,000 data points from the MLS and created these graphs to help visualize the resale market. I can produce similar charts for Meridian, Eagle, or your specific neighborhood if you’re curious. Just reach out!

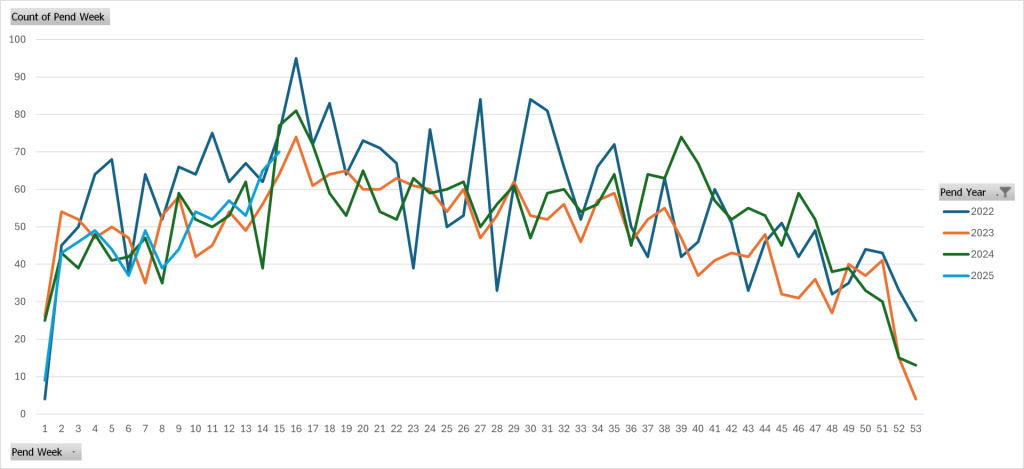

Pending Sales:

We’re seeing strong pending activity so far in 2025, with a clear boost in early April when interest rates briefly dipped to around 6.5%. Rates have since ticked back up, but buyer activity remains relatively strong. We’re nearing the seasonal peak for pendings, which typically occurs in May. Based on past patterns, I expect we’ll see a gradual slowdown month-over-month starting in June.

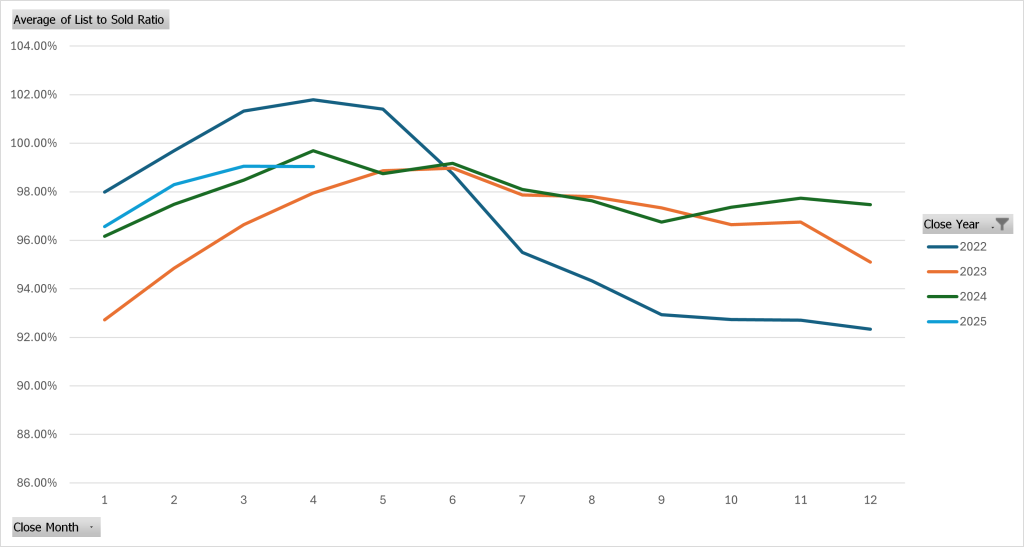

List-to-Sold Price Ratio:

So far this year, sellers are selling their homes close to their asking prices. The average list-to-sold ratio is hovering around 99% of the original list price. This is fairly solid, however, early April closings (which reflect February and March pendings) show a slight dip at a time of year I would expect list to sold ratios to rise. Based on what we’re seeing in the market on both the buying and listing side (and from what we are hearing from peers), I would expect that once pendings from April shift to closed, we’ll see that list to sold ratio further drop this year. In past market cycles, price drops have followed a dip in this ratio, as we saw in Q3 and Q4 of 2022. I think we are poised for a slight correction in the second half of 2025 unless we see a drop in mortgage rates.

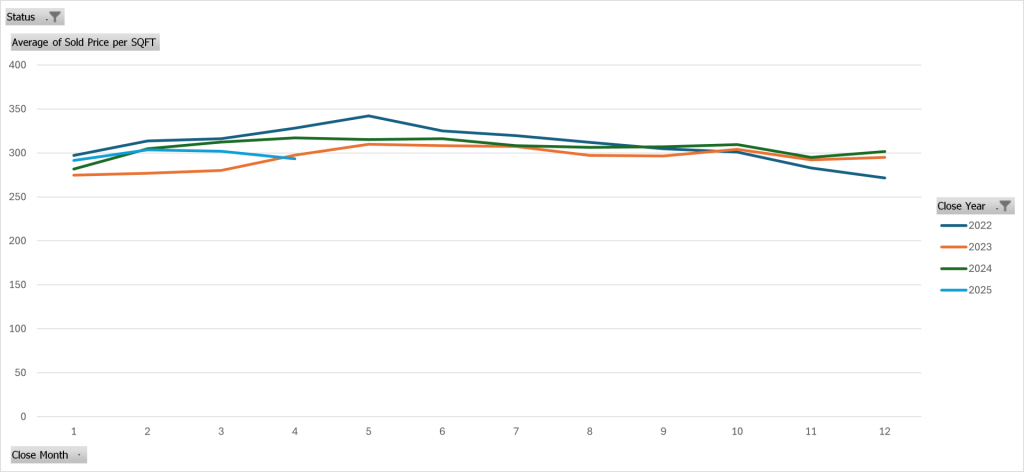

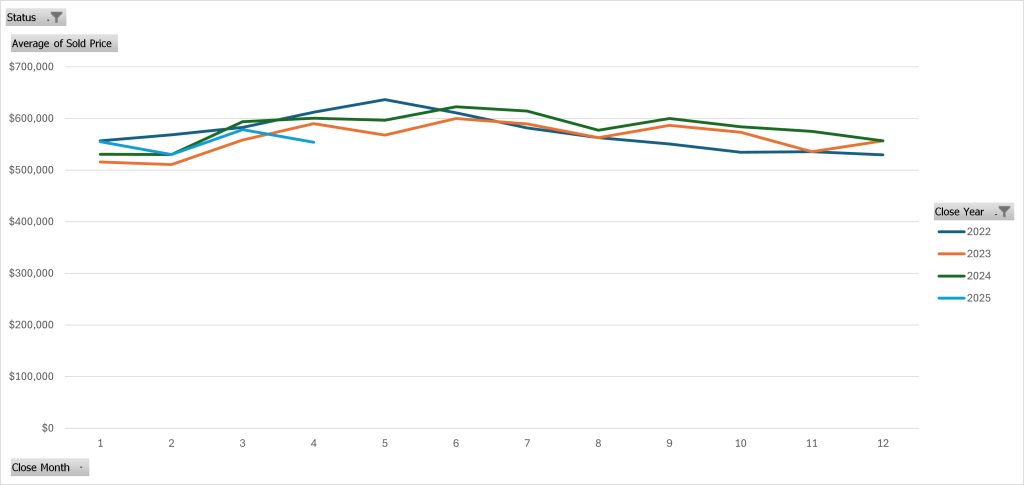

Sold Price & Price Per Square Foot:

Average sold prices are slightly down this spring, and sold price per square foot reflects a similar trend. Buyers are more price-conscious, largely due to higher interest rates.

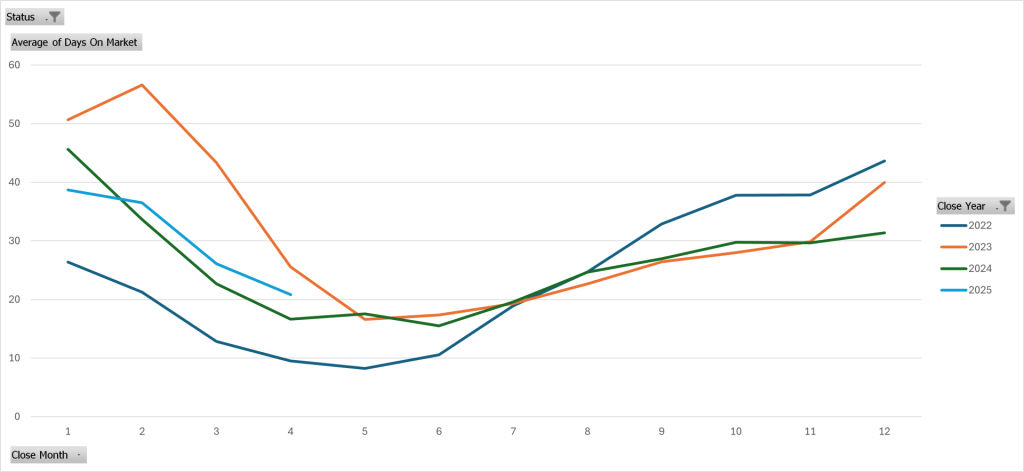

Days on Market:

Buyers are being thoughtful and taking more time. As a result, days on market are slightly higher than they were in 2024—though still tightening as we move deeper into spring.

Overall Takeaway:

Right now, the Boise market is healthy, but we’re seeing a few clues that we may have a weaker summer than 2024. Nothing dramatic has changed—yet. But I wouldn’t be surprised to see a more noticeable shift over the next 90 days. For sellers, the most important thing right now is preparation and pricing. Homes that are staged, neutral, turn-key, and priced to reflect market data are selling. Overpriced or dated homes? Not so much.

Buyers waiting for a big price correction may be waiting a while. At this moment, there’s no dramatic drop on the horizon—but I’m watching the data closely and will keep you posted.

Site by Ha Media

Site by Ha Media

Leave a Reply